WealthPack, a financial technology startup based in Gurgaon has launched a fully automated expense manager. Co-founded by three former investment bankers, WealthPack aspires to radically alter the personal finance landscape in India by changing the way people manage their money.

The team understood that only by maximizing one’s savings in a consistent manner can long term wealth be created. This inspired the co-founders to create an app that completely tracks and presents all the user’s expenses which are captured in SMS messages, allowing users to save more.

WealthPack works on SMS information alone - 100% secure!

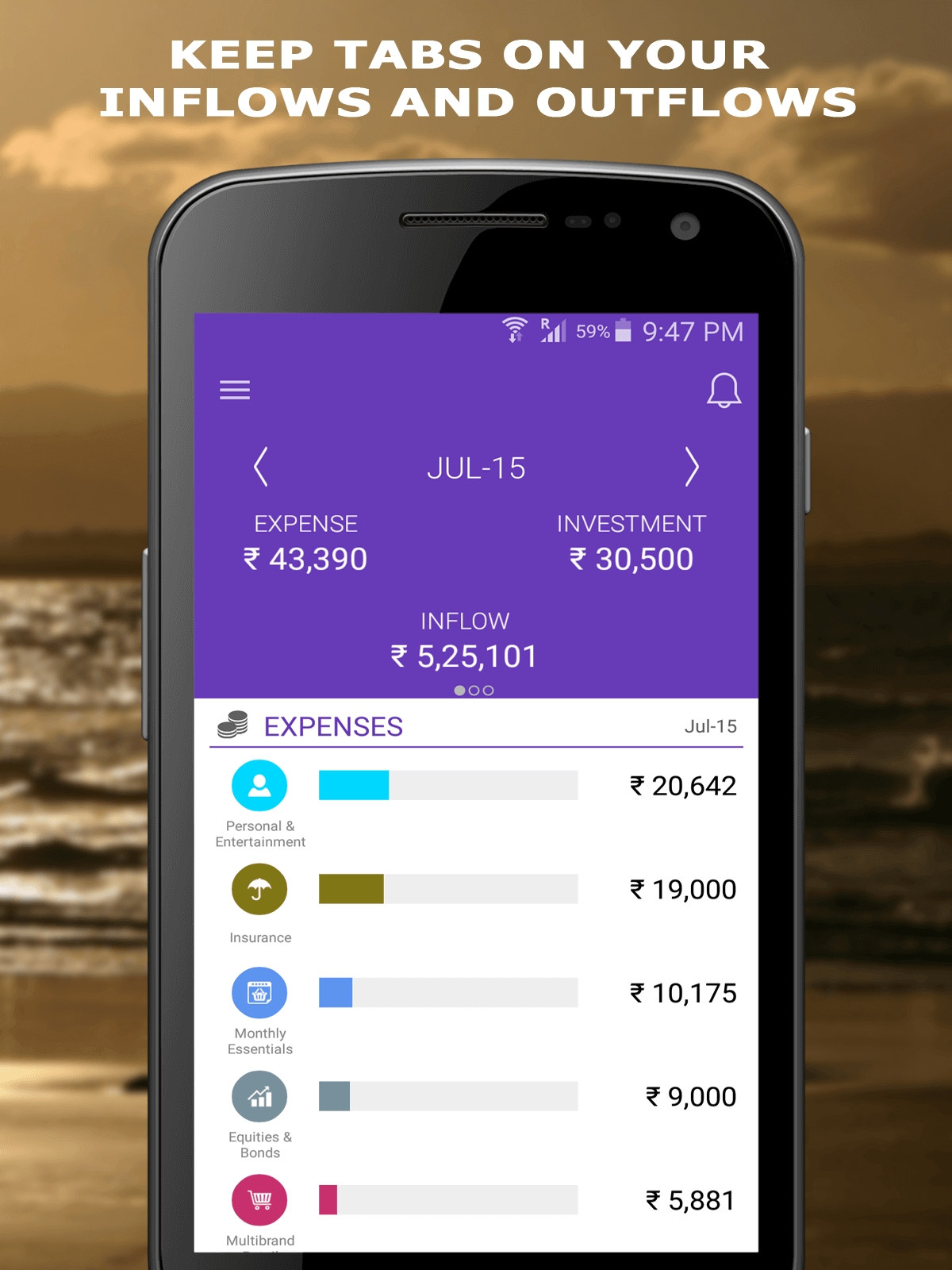

WealthPack makes use of financial information that resides in the SMS inbox of the users and presents a consolidated view of spending, bank accounts, credit cards and bills. It runs on smart algorithms to auto-categorize the transactions done by the users and then presents a category-wise (food, groceries, fuel, rent, etc.) view of the spending. WealthPack also displays consolidated bank balances, credit card dues and bill payments, all in an engaging user interface.

The sweet spot? Wealthpack covers 40+ banks and credit cards, credit card and telecom (Airtel, MTNL and Vodafone) bills. WealthPack’s coverage ranks among the highest in similar apps. Since it doesn’t require bank passwords or account numbers, the app is 100% secure.

“Like most people, I found existing apps to be inadequate and time consuming. Many didn’t cover my public sector banks and also misclassified my expenses” says one of the co-founders. “We have developed a robust machine learning algorithm that auto learns and makes the user experience interactive.”

WealthPack is fully automated - No manual inputs needed

WealthPack is meant to be a pure play personal finance app and differentiates itself from other players in the space by offering analysis. Some of the unique features include category wise analysis (how much spent on fuel, education or groceries for example). It also knows which spends are expenses and which are investments - all without any user intervention.

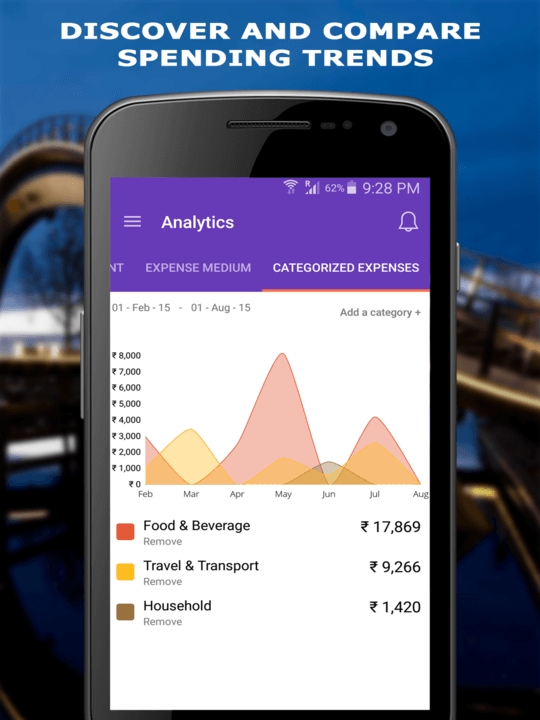

The app offers a range of features including the basic ones like consolidated view of accounts, spending and bills. It also offers tools for trend analyses over any time horizon (even upto 2 years). So if you want to visually compare your spend on food vis-a-vis spend on monthly essentials over the last six months, you can turn over to the Analytics section and compare the trends.

Another area where WealthPack is strong is segregation of investments from expenses. “What we are building in Wealthpack is better ways to organize your financial information”, says a co-founder. “The basic thing is to correctly classify expenses and investments”, he said.

IOU (I Owe yoU) is another useful feature which allows users to split expenses between friends and keep track of receivables and payables. It allows the ease of sharing with full tracking and replaces the rather cumbersome paper way.

Analytics help you save money – All automatically

One of the best aspects of the WealthPack app is that not only does it track all your expenses, it auto categorizes all expenses. For example – it can show you how much you spent on fuel or travel in the last month or even the last year (depending on how much SMS information you have retained on your phone). Some of the great analytics features are

- Ability to track all cash expenses: ATM withdrawals are automatically captured and collated in your cash wallet. But even if you want to manually add cash expenses you can do that. The app gives you the option to expenses the cash at the end of the month or carry it forward.

- Categorized expenses: The app gives you a break up of monthly essentials (rent , EMI, groceries, etc) Vs discretionary spending. How much you save boils down to managing your discretionary expenses well – and the app helps you in doing that.

- Expenses by account: Are you spending too much money on debit cards, you may be missing out on some of the rewards given by credit cards. Small things like that can add upto thousands of rupees saved in a year.

- Investments Vs expenses: Our wealth depends on the amount of money we invest for the long run. And the app helps you track exactly that – investments into FDs, Mutual Funds and Insurance – all automatically!

Insights helps you benchmark your finances to the overall community

One of the best aspects of the app and certainly something that users get hooked onto over time is insights. Insights give you specific examples of how you are doing versus the overall WealthPack community. So if you withdraw cash from ATM 5 times and the community only did 1.5 times, you know that’s one thing you can reduce (especially if you are paying cash withdrawal charges). It’s a lot of fun and useful for saving money too! The company promises even more detailed analysis that will help users get the most out of their money in the coming months.

Who are the people behind WealthPack?

WealthPack is started by three former investment bankers and financial markets professionals - Kunal Singh, Sanket Sinha and Ujjwal Ankur. The three founders have cumulative experience of 20+ years in Indian and international financial markets. They hope to change the way you save and invest your wealth!

Free Download Link for Android - Try it Today!

http://goo.gl/eNF1Mw

Related posts:

- 4 Smart Reasons to Apply for a Personal Loan A home or auto loan won’t be of any use if you are in urgent need of money to tide over a general financial emergency. You cannot use the money sanctioned towards a home or a car for any other purpose. Further, the lengthy formalities involved in these loans make them unsuitable for those in [...]...