Loan dilemma

Rajesh is a 24 year old student who can’t wait to lay his hands on the recently launched smartphone worth Rs. 15,000. The only hitch, neither does he have so much of savings nor is his pocket money so high and banks and NBFCs will not give him a loan as he is a still a student and doesn’t have any source of income.

Like Rajesh, there are many people who want to fulfil their various aspirations like buying a gadget or consumer durable, buying a vehicle, going for a vacation, higher education, marriage, starting a business or expanding an existing business or meeting medical emergencies. Quite a few people don’t get loans from banks and NBFCs. Some of the reasons for not getting loans include:

- The person is not earning and hence does not qualify for a loan

- The person has never borrowed before and hence doesn’t have a credit score and so does not qualify for a loan

- The person is earning less than the threshold set by the bank or NBFC to qualify for a loan

- The person is working in an industry which is excluded by the bank or NBFC for loans

- The person does not have enough collateral / security to offer against the loan

- The person has a bad credit history as the person has defaulted on loans in the past

- The person has just started a new business or the existing business lacks credibility etc. and so on

The list of reasons for not getting a loan can go on, but that is not the point. The point is how do these people get loans and fulfil their aspirations or meet any medical emergency that may arise. This is where peer to peer (P2P) websites like i2ifunding.com are filling the gap.

Peer to Peer (P2P) websites

P2P websites act as online intermediaries between borrowers and lenders. Through this platform, individual borrowers can get their loans financed directly by individual lenders. The borrowers then pay regular EMIs to lenders.

i2ifunding.com

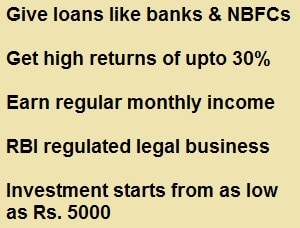

i2ifunding is one of India’s largest and fastest growing peer to peer lending website. It is a market place where an individual can borrow money at a desired rate of interest and an investor can lend to individual borrowers and earn high return on investment.

Any individual, who needs a loan, can create a borrower account by filling a simple and easy online form on the i2ifunding website. The borrower needs to enter his / her personal details, employment history, financial details and self-attested scanned copies of documents.

- The i2i team does the credit risk assessment using i2i’s proprietary Credit Score Model. The borrower is assessed on 40+ parameters such as credit history, education, job stability, income details and other behavioural pattern.

- Based on the detailed analysis, the underwriting team assigns a risk category and recommends an interest rate payable by the borrower.

- The borrower’s loan requirement is then made live to lenders, who can then make lending commitments.

- Once the funding is completed, the physical verification of the documents is done and a legal agreement is signed with the borrower.

- Once the legal formalities are completed, the lender can transfer the funds directly to the borrower’s bank account. From the next month the borrower starts paying the EMI to the lender.

Why borrow through i2ifunding?

- The borrower can get a loan at attractive interest rates than those charged by banks or NBFC, depending on the score arrived at using the proprietary Credit Score Model

- The entire loan process, application to disbursement, is online and is quick and hassle free

- There is no loan prepayment penalty for the borrower

- The loans are funded faster, as i2i funding as a large pool of lenders

Do you have a personal loan requirement?

So now you are aware of how i2ifunding works and why you should borrow from i2ifunding. If you or someone whom you know needs a personal loan for education, marriage, house renovation, consumer durables or gadgets, vehicle purchase, medical emergency etc. head straight to www.i2ifunding.com

About i2ifunding

i2ifunding has been started by 5 co-founders. It has some of the most well-known industry veterans on its Board. It launched operations in October 2015 and raised angel investment of Rs. 2 crores in May 2016. i2i is all set to change the way in which financial transactions are being currently carried out. In a credit starved country like India, i2i is carving its own niche. It is on a fast growth trajectory and is set to emerge as one of India’s largest P2P marketplace. i2ifunding.com has been awarded Startup of the year 2016 by Silicon India.