The used car industry has recently seen a boom. More and more people are opting to buy used cars over new cars. You might think that it’s just the young professionals in their early job years who go for used cars, but even people in their thirties and forties are considering second hand cars because of the affordability and the huge range of options available.

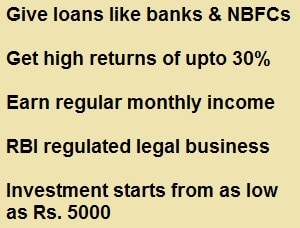

In addition to this, there are several used car loan options available at NBFCs and banks, making it easier for you to afford your dream car. But the process of finding the right lender can be quite unnerving. After all you must choose a deal that suits your needs and paying capacity the best. So here are a few factors to keep in mind when picking a lender for a used car loan:

1. Loan term: The term of your loan will make a huge difference to you, so you must put a lot of thought into it. Most lenders offer 5 year loans, as long as your car is less than 5 years old. For cars that are older than that, the loan tenure is usually shorter. So when you pick a used car, keep your repayment capability in mind.

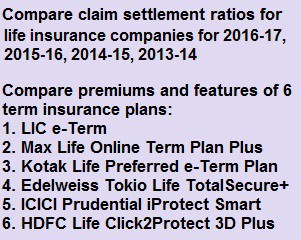

2. Interest rates: Go to several lenders and compare the interest that they are offering. Don’t just go to one lender, but take several quotes from different lenders to understand where you stand and which options would suit you the best.

3. Terms and conditions: Different lenders have different terms and conditions on their loans. So, after you get quotes from lenders, pick the one that suits you the best. Then, ask this lender for a letter underlining all the terms and conditions of the deal. This will make sure that you don’t miss out on any of the fine print.

4. Used car dealerships tie ups: You can also ask at the dealership you are purchasing your car from and check if they have tie ups with any financial institutions. This could help you avail attractive discounts and benefits.

Picking the right loan provider involves a lot of research and evaluation. Make sure that you do your homework before you pick one.